The Economic Mobility Act as Antipoverty Policy

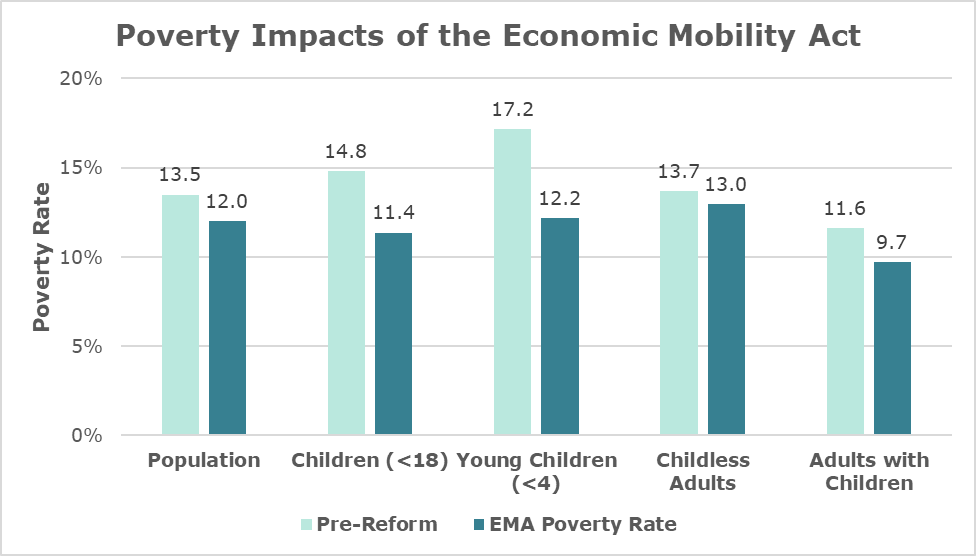

The Economic Mobility Act (EMA) was introduced by Representative Richard E. Neal and benefits Americans who traditionally do not get much from government tax benefits. We find that the EMA of 2019 would make a substantial investment in reducing poverty, lifting over 4 million Americans, half of whom would be children, out of poverty. It would cut child poverty by nearly a quarter and deep child poverty by one third. It targets low-income childless adults, low-income families with children, families with young children, and parents paying for childcare. We find that the bulk of the EMA's antipoverty impact is driven by the expansion of the Child Tax Credit to include all children. The EMA would also have modest antipoverty effects for childless adults by expanding the Earned Income Tax Credit.